Retail Banking

Public Bank posts 22.6% net profit surge in Q1

Public Bank posts 22.6% net profit surge in Q1

It expects market volatility to be heavily influenced by US and EU banking environment.

Cambodia's Sathapana Bank incorporates AI for credit risk management

It aims to power its credit risk management with Artificial Intelligence (AI).

Hang Seng warns customers of faux Instagram account

This is the fifth time in May that Hang Seng Bank warned of a fake account.

Maybank records 10.7% increase in Q1 profits

The group’s profit before tax also grew 2.7%.

Hang Seng says ‘be vigilant’ of new deceptive sites

Fraudulent websites may display the bank’s logo.

HSBC names new South Asia head of wealth and personal banking

Kai Zhan g will be responsible for expanding wealth management across South Asia.

Hang Seng organises $100m social loan for Unistress

This funding will entail establishing schools for children and transitional homes for low-income households.

HSBC appoints Wing Tai Properties CEO as independent non-executive director

Cheng has also been named to HSBC’s remuneration committee and risk committee.

Taipei’s Fubon Bank reports record-high Q1 profits

Credit card issuance also saw a surge.

Central bank rate cuts could raise Philippine banks’ earnings by 2.6%

Every 100bp rate cut would free PHP106b of liquidity.

Bank of East Asia to open select HK branches seven days a week

Cash transactions will not be available during the weekends.

Standard Chartered-FIS’ Worldpay to boost Straight2Bank Pay reach

This hopes to ramp up the bank’s functionalities to cater for businesses in Asia and other markets.

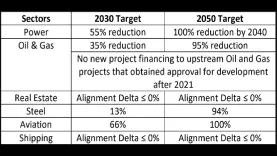

OCBC unveils decarbonization targets for six sectors

The bank commits to achieving a net zero status for its financed emissions by 2050.

Citibank Korea doubles net income in Q1

The net income of KRW84.9b for Jan-March 2023 is 112% higher than a year ago.

Bankers face sluggish hiring market, layoffs in Hong Kong

Industry insiders reveal how investment banks prioritize cost efficiency and productivity over hiring new employees.

Public Bank Berhad aims for $11b in ESG-friendly financing by 2025

It also plans to finance energy-efficient vehicles worth $7b by 2025.

Sumitomo Mitsui Banking Corporation’s net profit up to $9.34b for FY2022

Year-end dividend per share is JPY125 or US$92.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership