Staff Reporter

Techcombank net profit climbs 17.5% to $973.36m in FY2025

Techcombank net profit climbs 17.5% to $973.36m in FY2025

Q4 net profit nearly doubled on higher interest income and fee income.

Mastercard launches Fleet: Next Gen to streamline fleet payments in APAC

It offers acceptance in a million locations and data gathering capabilities.

Close gov’t supervision driving Evergrowing Bank risk upgrades

S&P flags legacy loan strain despite Shandong oversight push.

Westpac hikes home loan rates as it flags budget pressure

Westpac's consumer chief executive recognized that the increase may add pressure to households.

Payroll drives rural Indonesia banking uptake as digital banks fail to sway users

Digital banks are known but users said there is no difference in app experience.

Korean regulators hit 5 banks with record $1.38b in ELS penalties

Kookmin Bank will face the highest penalty if based on sales amount, the report said.

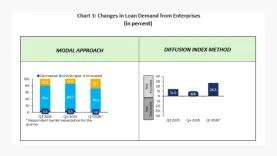

Steady loan outlook erodes as Philippine banks brace for Q1 squeeze

Banks expecting a flat borrowing appetite fell significantly from a previous high of 80.7%.

Japan Post Bank flags $23.47b unrealised securities losses to Dec

The book value of the securities is JPY29.86t.

Norinchukin fortifies JA Mitsui Leasing after $968m fraud allowance

Norinchukin is in talks with SMBC and other major banks to provide loans to JAML.

MUFG launches the Slim Course pension plan in iDeCo system

It offers zero management fees and aims for the industry’s lowest operating costs.

SMBC signs SBI pact to back India sunrise sector project finance

They aim to grow India’s “sunrise sectors”.

Vietnam banks face whiplash as fast lending fuels asset price risks

Credit growth target is 15% in 2026, but banks can be hurt if prices correct.

Malaysia credit growth eases to 5.3% as business loans cool

The banking system’s liquidity coverage ratio rose to 154.8% during the month.

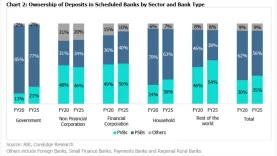

Indian public bank deposit share slumps to 56% as private rivals surge

Household savings held by private lenders climbed from 30% in 2020 to 35% by 2025.

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

The region is amongst the fastest-growing private credit markets globally, albeit from a smaller base.

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

HSB collects ground-level fraud signals that are captured in standardised entries.

Philippine banks signal credit squeeze as tightening bias grows in Q1

About 12.8% of banks expect to tighten credit standards for household loans.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership