Retail Banking

Vietnam's banks to issue more bonds as loan growth accelerates

Vietnam's banks to issue more bonds as loan growth accelerates

Loan growth will rise faster than deposits, leading to tight funding positions for the lenders.

India’s Bitget Wallet integrates Tether marketplace in its platform

It promises competitive rates.

Singapore and Japan renew bilateral swap arrangement

They can exchange local currencies of up to S$15b or JPY1.1t.

CIMB’s net profit up 2.34% to $502.6m in Q3

Non-interest income rose by over 20% during the quarter.

ICBC to meet increased capital req’s after G-SIB upgrade: S&P

Its 21.52% TLAC already exceeds the new minimum requirement

Banks struggle to keep pace as fintechs scale agentic AI

Most incumbent initiatives are defined by narrower applications.

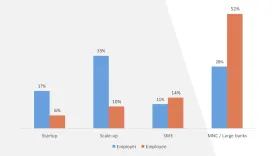

Singapore’s fintechs see mismatch between talent and hiring demand

Startups and scale-ups are the biggest employers whilst talent comes from MNCs.

This week in finance: CIMB Singapore's new card for sole proprietors; banks' real estate woes; in-app chat services heat up

GoTyme Bank is now compatible with Google Pay.

GoTyme Bank rolls out crypto investment services in the Philippines

Customers can invest in 11 cryptos without registering on a third-party platform.

Malaysia’s GXBank facilitated 220 million transactions in 2025

The bank has also disbursed about MYR25m to MSMEs via GX FlexiLoan.

APAC DM banks take on more risk as margins shrink

Aussie banks are growing their SME exposure whilst other banks are expanding overseas.

Citi boost FX team in Japan, JANA, and Asia South with new hires

New hires include a head of corporate FX sales in India and three director-level hires.

China Zheshang Bank credit costs to stay elevated over next two years

Loans to the property sector and inclusive finance will remain problems.

GoTyme Bank now compatible with Google Pay

Customers can pay without entering card details whenever there’s a Google Pay button.

CIMB's new card gives 114-day interest-free drawdowns to small businesses

It offers 114 days interest-free period for working capital loans.

RBI begins linking payments system with Europe’s instant payment settlement

The proposed linkage is expected to facilitate cross-border remittances.

BSP says customers can still withdraw over $8,750 without delays

Customers will need to show a legitimate purpose of withdrawal.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership