Retail Banking

Singapore big three banks to sustain strong dividends in 2026: report

Singapore big three banks to sustain strong dividends in 2026: report

Wealth management inflows and activities are expected to be robust.

Indonesia’s big four banks to hit 9.3% loan growth in 2026

Wholesale loans and microloans will growth during the year.

It’s the most wonderful time of the year

We’re taking the time off and will be back on 5 January 2026.

Why APAC banks must rethink their approach to the cost reduction challenge

APAC's fintech market is set to reach $304.55b by 2030, up from $144.87b today.

SCB X may rein in non-bank finance expansion amidst asset quality concerns

Its commercial bank business is expected to make up the majority of its net profit.

CITIC Bank to maintain stable profits and capital but at risk from bad loans

Asset quality should remain stable in 2026 and even through mid-2027.

Banks shift deposit strategy from rates to relationships

Wealth management is a key focus.

PNB inks loan facility agreement with DCFC to boost SME lending

The facility will be used to grant working capital loans to SMEs.

Indonesia's Superbank raises $167.06m in IPO

It will use 70% of the proceeds for working capital and 30% for capital expenditure.

Japanese megabanks set for better conditions in 2026

In contrast, Chinese banks and Hong Kong banks face “deteriorating” sector outlooks.

UnionBank names Gauraw Srivastava as wealth head and EVP

Srivastava was previously head of private banking at Vietnam’s VPBank.

SMBC APAC completes first SRT transaction

Its sponsor partners are Blackstone, Stonepeak, and Clifford Capital.

ANZ ex-CEO Shayne Elliot sues the bank

Elliot’s long-term variable remuneration was adjusted to zero for 2025 and 2026.

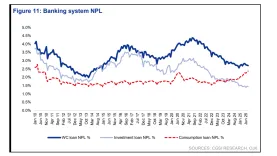

Indonesia banks see NPLs climb on mortgage and vehicle loan strain

CGSI said that banks should be more cautious of auto loans than mortgages.

Syfe achieves group profitability

Its AUM in Hong Kong grew nearly six-fold in 2025.

KBANK sees limited flood impact as interest income pressure looms

Policy rate cuts will lead to net interest income pressures in 2026.

TISCO Bank cautious on 2026 as it scales back high yield lending

It expects net profits to decline in 2025-26, but is confident it can maintain its payout ratio.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership