Staff Reporter

Standard Chartered launches SC Shop and Earn cashback on SC Mobile

Standard Chartered launches SC Shop and Earn cashback on SC Mobile

Priorty Private and Priorty Banking clients can earn up to 6.9% cashback on Agoda and Expedia.

SMBC to launch new startup video pitch platform as deal flow source

GoAhead invests in seed and early stage startups.

Indian bank credit jumps 14.4% in December as gold loans double

Power segment and ports drive infrastructure credit growth.

Singaporeans’ travel spend shift to Asia for snow and healthcare

They’re traveling to Thailand and South Korea for medical services.

BNI braces for NIM compression in 2026 on tighter H1 liquidity

NIM is estimated to fall between 3.5% to 3.8%, lower than Q4 2025’s 3.9%.

UOB set for growth as DBS, OCBC earnings hold steady: report

The sector benefited from dividend potential and provision write-backs.

Indonesia loan demand stagnates as MSME and consumption slumps

Underlying demand for loans remains uneven although liquidity will be abundant, analyst said.

Digital payments clock 13% growth as physical cards retreat

Super-apps reduce dependency on traditional products by bundling diverse financial tools.

MUFG’s profit up 3.7% to $11.5b in 9M 2025 as operating profit nearly triples

Net operating profit and net income have reached over 80% of full-year targets.

MUFG launches Artemis Ventures with $318.9m equity fund target

It will invest in mid-to-late stage startups, primarily those based in Japan.

ANZ rolls out agentic AI CRM tool that will save bankers 1 month of time

The new CRM consolidates data from 20 different platforms.

Citi hires Kriss Pachauri to lead ANZ global asset manager coverage

Citi says it has a “strong pipeline” in the financial sponsors segment.

India's public banks must cut branches to hit 'world-leading' goal: S&P

Indian PSBs are inefficient due to underutilised and low-yielding branches, an analyst said.

Only 1 in 10 banks see AI returns despite $97b spend by 2027

Data fragmentation and governance uncertainty plague most AI adoptions.

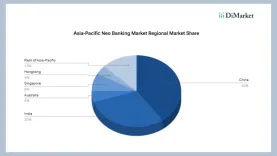

APAC neobanking hits $261b in 2025 as mobile use rises

China and India account for 70% of regional market share.

Mizuho hits 90% of profit target in 9 months as net income tops $6.4b

Its expanded share buyback shows confidence in its capital base.

Malaysian bank loan growth to stabilise at 4.5% to 5.5% in 2026

The 2025 slowdown to 4.8% seen as normalisation after 2024’s 5.5% expansion.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership