Retail Banking

Vietnam banks face whiplash as fast lending fuels asset price risks

Vietnam banks face whiplash as fast lending fuels asset price risks

Credit growth target is 15% in 2026, but banks can be hurt if prices correct.

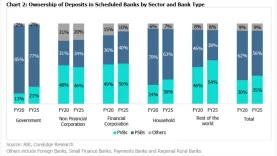

Indian public bank deposit share slumps to 56% as private rivals surge

Household savings held by private lenders climbed from 30% in 2020 to 35% by 2025.

SMFG profit up 22.8% to $8.99b in 9M on higher income

It forecasts an annual cash dividend of JPY157 for the fiscal year.

DBS Hong Kong names Xu Qing as managing director and risk head

Xu will oversee all credit and risk functions in Hong Kong, mainland China, and Taiwan.

Failed P&N-CUA merger won’t slow Aussie mutual bank consolidations: S&P

The two banks are expected to continue seeking consolidations.

PNL and Great Southern Bank scrap merger

The two Australian banks’ boards agreed to terminate their MOU.

Citi rolls out evergreen private market funds for HNW clients

It has partnered with Blackstone, Blue Owl, and KKR to launch the funds.

Standard Chartered names Ryan Song as head of M&A in Korea

He is expected to help grow the bank’s M&A advisory business in the region.

MUFG Bank invests in GLIN Impact Capital 2 to back ESG growth

The investment aligns with the bank’s medium-term business strategy.

Banks bet on 2026 growth as India challenges China for capital

China and India are the markets to watch out for.

Banks risk wealth advisor exits without tech upgrades: Cerulli

Just 8% of wealth advisors in the Americas are not yet using wealth tools.

Weekly Global News Wrap: Stablecoins threaten $500b in deposits; Italy funds bank rescue

And about 100 jobs in Metro Bank are at risk.

Japan Post Bank merges investment arms to form new asset manager

JP Asset Management will be the surviving entity.

Korea’s outstanding deposit rate fell in December whilst loan rates climbed

Rates for new deposits rose during the month.

South Korea rewrites bank loan-deposit rules to push regional lending

Regulators plan to upgrade rules and provide incentives to improve regional banks’ competitiveness.

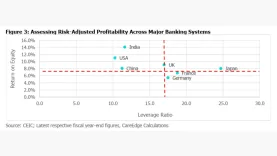

Indian banks outclass Western peers with high-return, low-leverage model

The study groups India where lower gearing aligns with higher performance.

Security Bank names new wealth segment head

The Philippine bank also announced the retirement of EVP Gina Go.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership